Every technology goes through stages as it diffuses into the market. This has been characterized as the Technology Adoption Curve; differing groups of people adopting a technology over time with each having different expectations for the product. What is frequently left out of such discussions is the change in the product itself. That is, Technology Adoption Curves often don't discuss the fact that the underlying technology and the product itself is evolving and improving as time progresses. If instead of looking at the adoption of a product by classifying the people that use a product at given stages of development, let's focus on what different customers ask about a product as a technology matures. Doing that we get a slightly different picture.

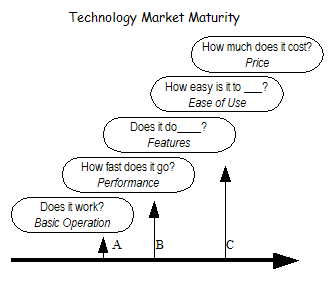

As a technology market matures it passes through five stages. At each of these stages the products are more and more mature and the customers care about different facets of the product. Here is graph showing the five stages over time.

The five stages are:

- Basic Operation

- Performance

- Features

- Ease of Use

- Price

I've now worked in three different technology fields, material testing, spectrophotometers and liquid handling robots, and my current field, which I'll keep a secret for now. At each of the companies I've worked for I have watched products move through all these stages.

Does it work? At each of these stages in maturity customers will weigh the facets of a product differently. In the first stage, at the introduction of a new technology, purchasing decisions are based solely on performing the desired function. Does it work? Does it come close to working? If you squint your eyes could you imagine it working?

How fast does it go? At the next stage customers begin to care about performance. We're past the basics and the technology seems to function, so now when comparing two similar products the differentiator becomes not, "Does it Work", but "How fast does it go". Performance doesn't mean only speed, it can relate to other characteristics. For example, in the material testing world performance was often mesured in the number of bits in your ADC (Analog to Digital Converter), and also the rate (Hz) at which the data was sampled.

Can it do ...? After performance comes features. If your new LED calculator had not only basic arithmetic but also did square roots, whoa, that may be enough to sway your purchase. In the material testing many of the features of the software related to the types of calculations that you could perform, the complexity of the tests that you could run, and the ability to interface to other types of equipment (micrometers, environmental chambers, bar code readers, etc).

How easy is it to use? Once performance and features are roughly at parity then purchasing decisions are guided by ease of use. Does that PC run under DOS or Windows? How easy is it to setup and run a test that complies with ASTM D638?

How much does it cost? And finally, after ease of use has risen to a high enough level across all the products, purchases will be made on price. It's interesting to note that price is the last decision point. Given the amount of time I've seen marketing and product management devote to 'competitive pricing' for products, you would think that price, and price alone, guided purchases.

Caveats. There are, of course, caveats to be applied. If I had more time, and a better drawing package, I would have made each of the blocks long thin ovoids that stretched across the page. Not only because I like the word 'ovoid', but because these regions are not as rigid in real life. You have to care about performance all the time, and features all the time, and ease of use all the time. You will always be adding features, but after a while the rate at which new features are added declines and customers look to manage the growing product complexity by weighing ease of use more heavily. The bubbles don't represent the only facet of a product the customer is looking at, but the one that is given the most weight.

The other caveat is that for this chart to apply you really have to be looking at products that are competing against each other, that is, a customer would look at all the products as competitive replacements for each other. This is where market segmentation comes into play. Just to make this point clear, Hyundai is not a competitive replacement for Mercedes-Benz and Apple is not competing with PCs.

Lather, Rinse, Repeat. Like I said, in each of the three industries I've worked in I have seen these same patterns repeated over and over again. For example, I'm sure electro-mechanical tensile testers went through these stages when they first came out. By the time I was working in the field a technological wave was rolling through material testing as people started hooking up PCs to material test frames. While the underlying technology of material testing is old, and the methods didn't change, you still just pushed or pulled stuff until it broke, the introduction of the PC forced the industry as a whole to go through all the steps again. Do you have a PC based controller? How fast is you PC based controller? Can your PC based controller interface to my micrometers? How easy is it to run ASTM D638 on your PC based controller? How much does you PC based controller cost?

In the spectrophotometer business it was again the adoption of PCs as controllers/interfaces, but this time it was the migration from DOS based to Windows based applications. The DOS products had reached a certain level of maturity, but when Windows came out everyone was forced to re-write or port their applications to Windows. At first there was a huge decrease in features and performance, the new Windows applications didn't have nearly the feature set of the DOS applications and they also ran slower than their DOS counterparts. Again, the introduction of a new technology to an already established market caused that market to go through all the stages of market maturity.

So What? Like I said at the beginning, there's a benefit to looking at a market in this manner. If your market is sitting at position 'A', then you're focusing some of your efforts on getting the product to work and most of your effort on getting it to work well. Looking at the market this way allows you to see what is coming next and how you should prioritize your development. If you're sitting at 'A' should you be working on cost-reducing your product? No. If you're relatively close in price to the rest of the products on the market it's just not worth the effort. Any price advantage you achieve will be for nought when the market moves on to demanding more features and your left selling a cheap, but less feature-filled product. Instead, if you have the time and money, start adding in new features, increase the flexibility and power of your product, because that's the next stage of competition.

What happens if a new competitor drops into the market and enters at position 'B'? A leapfrog like that could cause some trouble. But this also points out another aspect of a maturing market, barriers to entry. In my experience way too much time is spent on intellectual property as a barrier to entry. Let's be clear, IP fights can drag down the whole market and are expensive to litigate not only in legal costs but also in terms of your customers perception of you. Ignore IP for now and suppose a market has matured to position 'C' and someone tries to enter the market at 'B', can they really be called a competitor? If you are well into 'Ease of use' and starting to work on 'Price' and a competitor is still working on performance and starting to add features then you're not really playing on the same field, are you? In this case the company at 'B' will either struggle for a while to catch up to the pack or they will differentiate themselves and go after another market segment. Again, think Hyundai and Mercedes-Benz, or if you're a power tool person, Black & Decker versus DeWALT.

Summary. Use the chart, know what your customers are going to be asking for next, and never, ever, be suprised when an innovation comes along and throws you and your mature market back to square one.

I think this would wrap up how apple took the world in personal mp3 players, even though they entered the market late, with a product that was more expensive, and had less features than the competition.

The originals, the Creatives et al, made products that geeks loved. Apple made a product that non-geeks could love. The market transitioned from features to ease of use.

The interesting thing here is that geeks still hate the iPods because their <insert random mp3 player here> still has more features, charges faster, plays FLAC/OGG/<random codec>. And geeks are lost for words on why their 14 year old niece wants a 5gig iPod.

Thanks. :-)

Posted by Brett Morgan on 2005-03-09

Joe Gregorio

Joe Gregorio

Well written. I'd also say that most conversations one has as a tech start-up with investors, customers, or partners follow a similar pattern: does it work, how well does it work, will people use it, how will people use it, how much is it?

Also, when developing a new piece of technology, I've found that following your stages of maturity, as a priority list of development, works pretty well. In a nutshell, first make it work, then make it pretty.

Posted by anonymous on 2005-02-25